Why a Secured Credit Card Singapore Is Important for Structure Your Credit History

Why a Secured Credit Card Singapore Is Important for Structure Your Credit History

Blog Article

Revealing the Opportunity: Can People Discharged From Insolvency Acquire Credit Rating Cards?

Understanding the Impact of Bankruptcy

Upon declaring for bankruptcy, individuals are confronted with the considerable consequences that permeate various elements of their monetary lives. Insolvency can have a profound impact on one's credit report, making it challenging to gain access to credit score or car loans in the future. This monetary discolor can stick around on debt records for a number of years, affecting the person's ability to safeguard favorable rate of interest or financial chances. In addition, personal bankruptcy might lead to the loss of possessions, as specific ownerships might need to be sold off to pay off creditors. The psychological toll of insolvency need to not be taken too lightly, as individuals might experience sensations of embarassment, anxiety, and guilt as a result of their economic situation.

Moreover, personal bankruptcy can restrict work possibilities, as some employers conduct credit score checks as component of the working with procedure. This can posture an obstacle to individuals looking for brand-new work prospects or profession improvements. On the whole, the influence of personal bankruptcy expands past monetary restrictions, influencing different facets of an individual's life.

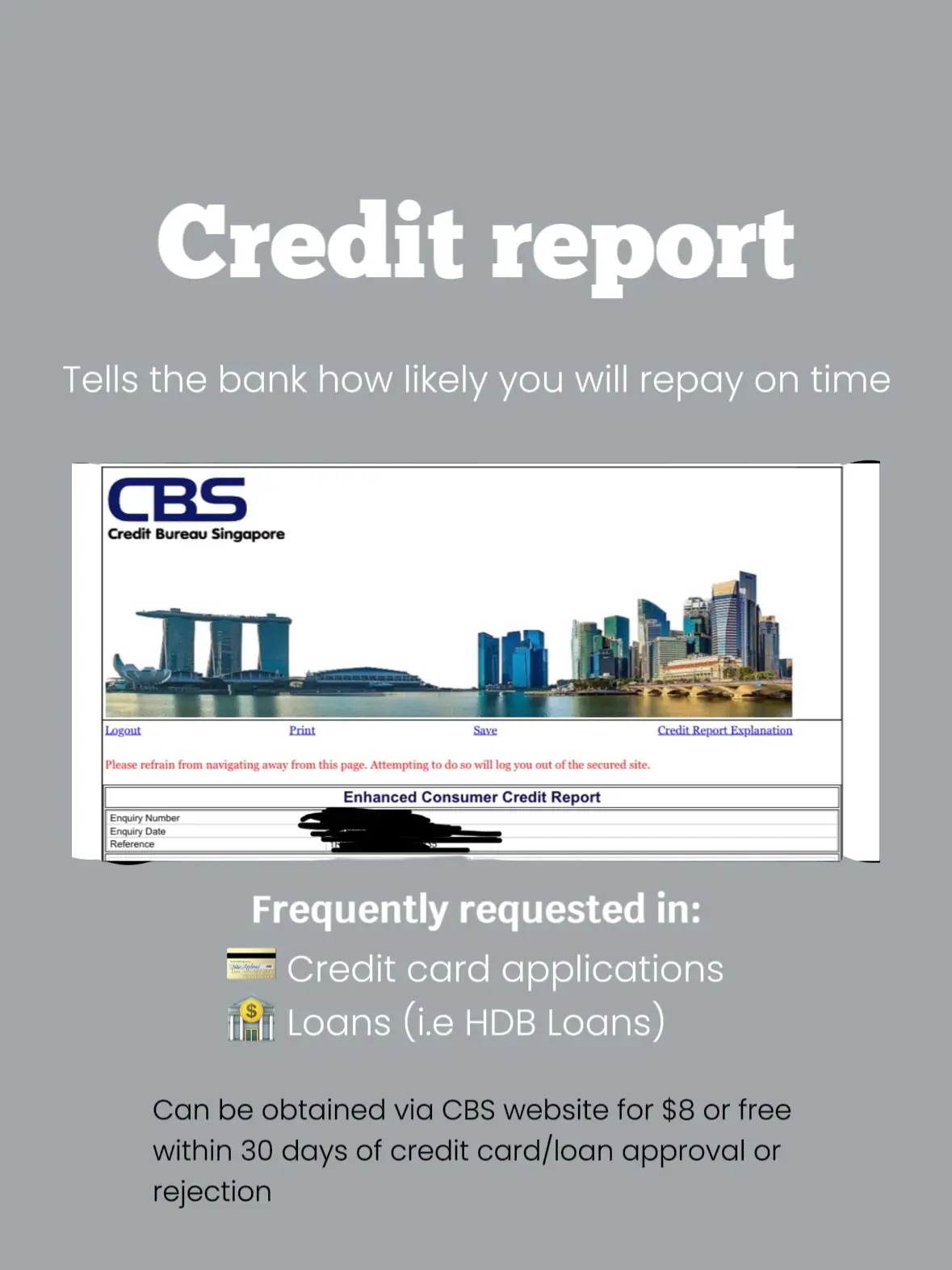

Factors Affecting Charge Card Approval

Getting a credit history card post-bankruptcy rests upon different key variables that considerably influence the authorization procedure. One vital element is the applicant's credit report. Complying with personal bankruptcy, people usually have a low credit history because of the unfavorable impact of the bankruptcy filing. Credit scores card business normally try to find a credit history that shows the candidate's capability to handle credit rating properly. An additional vital factor to consider is the candidate's revenue. A steady earnings guarantees credit score card companies of the individual's ability to make timely payments. Furthermore, the length of time because the personal bankruptcy discharge plays an essential role. The longer the duration post-discharge, the more desirable the opportunities of authorization, as it indicates financial stability and liable credit report behavior post-bankruptcy. Moreover, the kind of bank card being obtained and the provider's certain my website requirements can additionally affect approval. By carefully taking into consideration these variables and taking actions to rebuild credit rating post-bankruptcy, people can enhance their potential customers of obtaining a bank card and functioning in the direction of economic recovery.

Actions to Reconstruct Credit Scores After Personal Bankruptcy

Reconstructing debt after insolvency needs a calculated strategy concentrated on financial self-control and consistent financial debt administration. One efficient method is to get a secured credit history card, where you deposit a particular amount as collateral to develop a credit scores restriction. Furthermore, think about becoming an accredited individual on a household member's credit card or exploring credit-builder fundings to further increase your credit rating score.

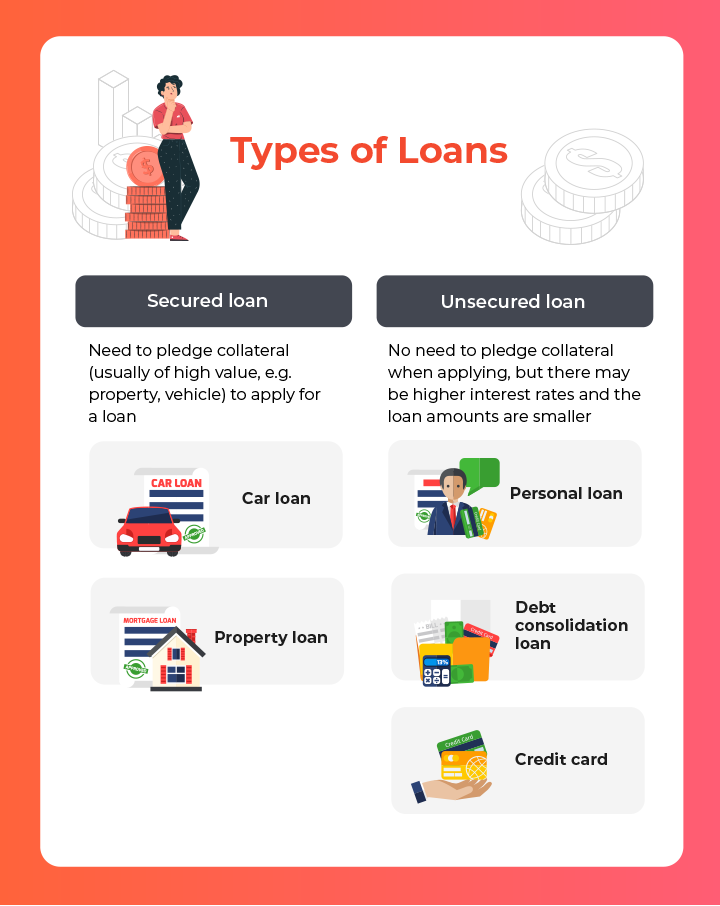

Safe Vs. Unsecured Credit Cards

Complying with bankruptcy, individuals frequently take into consideration the choice in between protected and unsafe credit report cards as they intend to rebuild their credit reliability and economic security. Safe credit history cards need a cash deposit that serves as security, normally equal to the credit report restriction granted. Ultimately, the choice in between protected and unprotected credit score cards need to line up with the person's economic goals and ability to manage debt sensibly.

Resources for Individuals Looking For Debt Reconstructing

For people aiming to enhance their credit reliability post-bankruptcy, discovering offered sources is crucial to efficiently navigating the debt restoring process. secured credit card singapore. One useful resource for people looking for credit rating rebuilding is credit therapy agencies. These organizations supply financial education, budgeting assistance, and individualized credit rating improvement strategies. By collaborating with a credit rating therapist, people can gain understandings into their credit scores reports, discover strategies to enhance their credit report, and receive support on handling their finances efficiently.

Another useful resource is credit history tracking solutions. These solutions permit individuals to maintain a close eye on their debt reports, track any errors or changes, and detect prospective signs of identification burglary. By checking their credit score on a regular basis, people can proactively attend to any kind of issues that may arise and guarantee that their credit scores info depends my explanation on date and exact.

Additionally, online devices and resources such as credit rating simulators, budgeting apps, and monetary proficiency sites can give individuals with beneficial details and tools to help them in their credit scores restoring journey. secured credit card singapore. By leveraging these sources efficiently, people discharged from personal bankruptcy can take significant actions in the direction of enhancing their debt health and wellness and safeguarding a far better monetary future

Final Thought

In conclusion, people released from insolvency may have the opportunity to acquire bank card by taking actions to rebuild their credit report. Elements such as credit score debt-to-income, revenue, and background proportion play a considerable duty in bank card approval. By comprehending the impact of insolvency, picking in between safeguarded and unsafe charge card, and using resources for credit rating rebuilding, individuals can enhance their credit reliability and potentially acquire access to credit cards.

By functioning with a credit score counselor, individuals can obtain insights into their credit history reports, find out methods to improve their credit rating these details ratings, and get guidance on managing their financial resources properly. - secured credit card singapore

Report this page